If you’ve always desired to learn to trade Ethereum but have no idea where to start, this guide is perfect for you. We are going to focu...

What is Ethereum?

Ethereum is basically an open-source, decentralized platform built on blockchain technology, which enables developers to write code that controls money and create new kinds of applications accessible worldwide. Launched in 2014, Ethereum is powered by its native cryptographic token called Ether (ETH). Essentially, when you hear someone say they trade Ethereum, they’re actually trading ether.

In the recent past, Ethereum has garnered a lot of attention, which has led to major volatility. With a history of prices fluctuating up to 31% and more in a single day, an equivalent of up to three to four hundred million USD of ether is traded every day.

With the world of virtual currencies being as fragile as it is, keeping abreast of new developments is indispensable. Take a dvantage of that volatility by exploring these three profitable trading strategies that give you an edge in the world’s second-largest crypto coin.

Reputable Ether Brokers

Although the “best” ether broker will often be a matter of personal liking, here are our findings for the best brokers suited for Ethereum trading:

Different Ways to Trade Ethereum

There are three main styles of trading ether, which are dependent on the timeframe and period the trade is open for. These methods are- Day Trading, Scalping and Swing Trading. Now let’s take a deep dive into each method so you can decide which one suits you.

Scalping (Short-term)

Have you been to a thriller movie that keeps you on the edge of your seat? Well, that same feeling is what you get when scalping–exciting, fast-paced and mind-rattling all at once.

Scalpers hold on to a position for a few seconds or minutes at most. They aim to grab small amounts of pips as many times as possible during the most active sessions of the day. Ethereum being a volatile pair can prove profitable using this strategy.

As an ether scalper, you need to have a good entry and a solid exit plan to make profits. Keep a keen eye on the growing trading volume, set up a tight stop-loss, and move on with small gains.

Day Trading (Short-term)

Unlike scalping, a day trader takes a slightly more relaxed approach in their trading. These traders love picking aside at the start of the day, act on their bias, and then end the day at a loss, or profit. No position is held overnight to avoid the risk of being adversely affected by large moves that may occur at night. Trades are only held for a few minutes or hours, and therefore ample time is needed to analyze the market and keenly monitor positions throughout the day.

Swing trading (short/medium-term)

While scalpers and day traders are happy coming home with a little less, swing traders target bigger profits by holding trades for a longer period. Swing traders seek to maximize gains by holding trades anywhere from overnight to several weeks. The idea is to capitalize on a greater price shift as possible in an Intraday timeframe. However, following larger price range and shift, they need calculated position sizing to reduce downside risk.

Unlike day trade, however, swing trading puts you at risk of overnight gaps against your positions. As a result, you ought to take smaller position sizes than if you were day trading, as intraday traders often utilize leverage to take larger position sizes.

Analysis Methods: Fundamental vs. Technical

Fundamental Analysis and Technical Analysis are two schools of thought used by traders to gain a profound understanding of the opportunities and to foretell the likely movement of the future price of various tradable assets. In truth, none of the two analysis methodologies is superior to the other and can thus be used together or exclusively. Either way, they can’t accurately forecast future prices. The idea is to bring a positive balance between the profits you gain and the losses you make along the way.

Fundamental Analysis

Fundamental analysis operates behind the underpinning concept that the current value of a commodity ought to be a reflection of basic economic factors. However, the cryptocurrency industry is still evolving, which makes it tricky to get reports on financial results, including earnings, profit margins, revenues or other relevant data.

So, how is the fundamental value of virtual currencies such as Ethereum estimated? Well, you need to conduct crypto research and market analysis on Ethereum technology’s potential. Ask questions such as:

- Is the technology used innovative?

- What is its market share?

- Who are the stakeholders of this project, and what have they already achieved?

- How many people/projects use or benefit from it?

- How many stakeholders are there and what’s the nature of their partnership?

Answering these questions helps draw a conclusion on whether it’s worth considering this crypto pair and how risky it is investing in it.

Technical Analysis

Instead of looking into the value and the actual operation of the company, this method evaluates investment based on market activity. It looks at relevant factors such as:

- Historical pricing of Ethereum

- Industry trading trends

- Trading volumes over time

The goal here is to capitalize on pricing trends and opportunities based on market activity around crypto. Now that this technique is purely based on historical market activity, it’s considered a backward-looking methodology.

Reading Price Charts

Charts are the heart of trading. Besides helping you monitor the value of your current position as a trader, they show where price has been, and by doing that, provides hints about where the price is likely to go next. It is for this reason that it’s imperatively important to know the various types of charts used in trading.

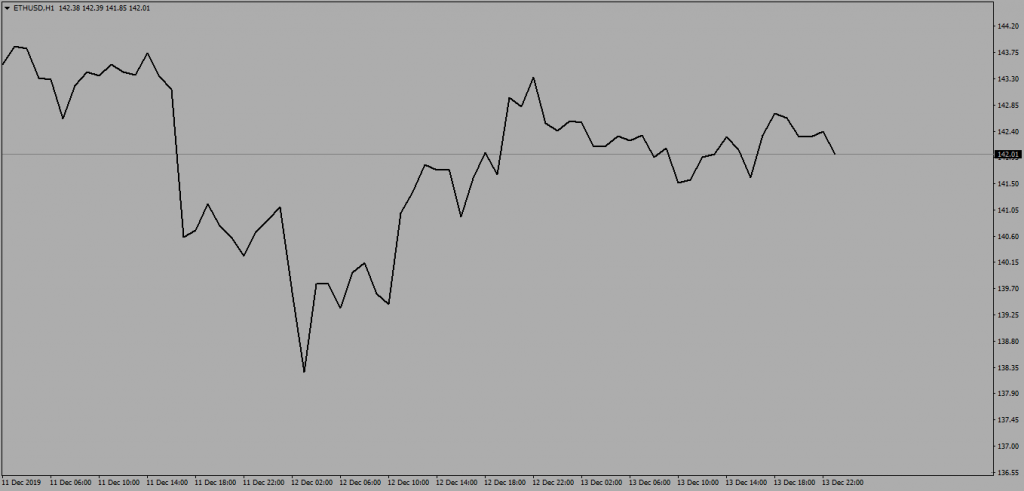

Line Charts

A line chart is the most basic type of chart that draws a line between two closing prices of the timeframe you are viewing.

It mainly used to show the general movement of the price of a crypto pair of each trading day. Below is an example of a line chart.

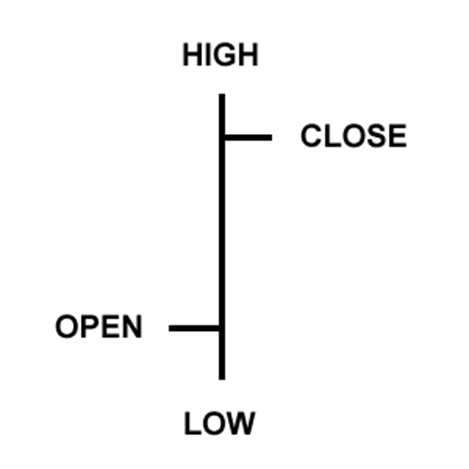

Bar Charts

Being a bit more complex, bar charts show not only the opening prices and closing prices but also the highs and lows. The idea behind these chats is to help traders establish who is in command of the market – buyers or sellers!

The other name for bar charts is “OHLC” because they show the Open, High, Low, and Close for the pair you’re viewing.

- High: The top of the vertical line is the highest price traded during the selected timeframe

- Low: The bottom of the vertical line is the lowest price traded during the selected timeframe

- Open: This is the first price at which crypto trades during a regular trading session

- Close: This is the last price at which crypto trades during a regular trading session

Below is an example of a bar chart.

Photos:

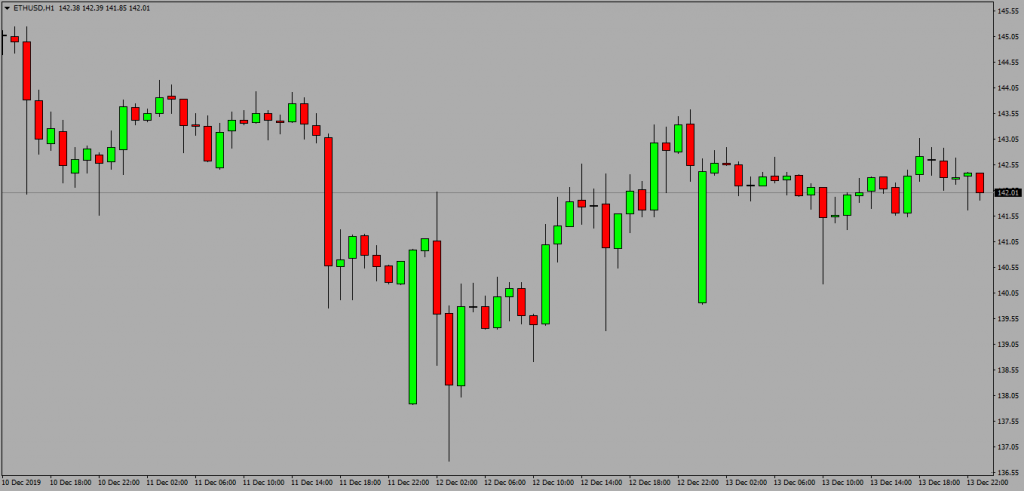

Candlesticks Charts

Just like a bar chart, candlestick charts also show similar price information, but in much lovelier, graphic format. It’s no surprise that it’s the most commonly used chart by traders. Besides showing a high-to-low range of a specific timeframe, it has a colored body between the opening and closing prices that reflects the true color of the market—Bullish or Bearish.

Unlike a bar chart or line chart, candlesticks build patterns, channels, peaks, and troughs in the price which are used to predict price direction once completed. Those tools are also used to set take profit and stop-loss levels.

Why Traders Love Candlestick Charts

- Easy to read: Candlestick chart is a good starting point for beginners to start learning more about forex chart analysis.

- User-friendly: Visual aids are imperatively helpful in learning, and by utilizing candlesticks, your eyes adapt quite fast to the information found in the bar notation.

- Cool names: Names such as “shooting stars and three white soldiers” used in candlestick patterns help in recalling what the pattern means.

- Essential in identifying market reversals: Turning points from a downtrend to an uptrend and vice versa is easier to tell using candlestick charts.

Photos:

Understanding Ethereum Trading Terms

Some Blockchain terminology can be quite tricky to follow for the average trader, and Ethereum is no exception. To begin your trading journey, you need to familiarize yourself with the most common terms to avoid confusion and frustration.

Limit Entry Order vs. Market order

Also known as a buy limit or sell limit, a limit order is an order traders place to sell above the market or buy below the market at a particular price.

For example, if Ethereum was currently trading at 1050 and you want to go short when the price reaches 1100, you can set a SELL limit order at 1100, and walk away to attend other matters. If the price goes up to 1100, your trade will be automatically executed at the best available price.

A BUY limit is the opposite of a Sell limit. You set a buy limit order at a price below the current market price in anticipation that the price will go up once your order is executed. You only use this method if you are certain price will reverse after hitting your specified price.

A Market Order, however, is a sell or buy order to be executed immediately at the current market prices. You can choose to sit in front of your monitor, wait for price to hit 1100 and then click a sell market order.

Stop-Loss Order vs. Take-Profit Order

A stop-loss order is a type of order linked to a trade to prevent more losses if the price goes in a contrary direction to the initial trade. This can be achieved by setting a stop-loss level, a specified number of pips away from the original entry price.

If you are in a long position, it is called a sell STOP order, and when you’re in a short position, it is called a buy STOP order. A take profit order is an order that closes your trade once it reaches a certain level of profit. Once your take profit order is hit, the trade is closed at the current market value.

Ethereum wallet

Before you begin the transaction process, you will need an Ethereum wallet to hold and store your Ether instead of a bank account. There are different types of Ethereum wallets, but the major ones include Ethereum hardware wallet, Ethereum software wallet, and mist wallet.

Hardware wallets are deemed the most secure way of storing Ether and can be connected to your computer to keep your Ethereum private keys offline. Software wallets are usually free of charge but are less secure because they are connected to the internet and can be easily hacked. Mist wallet is a form of software that is used to connect to different blockchain networks (public or private) using the well-designed UI page.

Gas

“Gas” in Ethereum means “gas limit”–the amount of transaction cost that is needed to successfully execute a contract on the Ethereum blockchain platform. The gas limit on Ethereum is measured in units of “gas.”For example, if you want to execute 4 lines of code successfully on Ethereum, it will need 4 gas units. Compare this to your Car, which consumes 4-gallons of gasoline for a 4-mile drive.

Smart contract

A smart contract refers to a digital contract encoded on a blockchain specially designed to host such contracts like Ethereum. It is deployed on an address and cannot be changed or moved afterward. The contract runs and executes automatically with no interference from a third-party. A smart contract is publicly available to everybody to read and use and usually comes with new tokens. The tokens are minted at the contract deployment address.

How to Trade Ethereum Stock

Most people have tried to mine Ethereum but have ended up frustrated due to the high up-front costs. The good news is that there is always an alternative; you can make money from Ethereum through investing in Ethereum stocks or trading Ethereum derivatives. To understand this dicey topic further, let’s dive deeper into how Ethereum market functions under the hood.

Buy and Hold Ether Trading Strategy

You need to open an account with a reliable cryptocurrency exchange; most of them allow you to sell or buy Ether directly. However, you need to fund your account through buying ether using fiat currency. You can use your credit card or bank transfer to do this. With that said and done, you can place an order to buy Ether (Ethereum stock). Typically there is an upside potential in Ethereum, which attracts traders to this buy and hold approach.

Buying and holding Ethereum is, however, exposed to security risks of theft. Therefore, storing your Ether in a crypto wallet will help protect it from cyber insecurities. Depending on your needs, you can either use hot storage or cold storage. What’s the difference?

In simple terms, hot storage is a device that’s directly connected to the internet such as desktop clients, exchange wallets, and mobile wallets. What makes it “hot” is the fact that it’s easy to access funds on a hot wallet and it’s thus best to store your Ethereum here if you want to use it more frequently.

Just as the make suggests “cold storage,” on the other hand, is useful if you want to store your Ethereum for a long time. Given the amount of attention cryptocurrency is receiving is the recent past, cold storage is the most secure because it’s not connected to the internet.

After your ether is bought and stored, you can monitor price movement and determine when the best time to sell will be. Unlike in trading Ethereum derivatives through CFDs where you can buy or sell Ether at any time, Buy and hold strategy only allows you to sell Ether after months or years and is thus considered a long-term investment.

Where to Trade Ethereum

Now that you know how to trade Ethereum, here is where you can trade it.

- Coinmama: Operating in the crypto space since 2013, coinmama is a worldwide trader of Ethereum that allows you to trade using bank wire transfers or credit cards.

- eToro: eToro is a cheaper option for price speculators who do not need to hold actual Ether for long. It allows you to trade using fiat currency without an Ethereum wallet.

- CEX.io: You can use CEX.io brokerage service to buy ether directly. You can simply open a CEX.io account, add your preferred payment method and choose the amount of Ethereum you wish to trade.

- Bitpanda: This is a platform that specializes in trading cryptos within the Eurozone. It has an intuitive interface for trading Ethereum and its services are relatively quick. The only concern is that it doesn’t list transaction fees, and you will need to calculate the fee charged from the final price.

Common Ethereum Trading Mistakes

If you have an internet connection, a computer and a few hundred dollars, what’s stopping you from kick-starting your career in crypto trading? Well, easy entry is not a guarantee of a quick profit. Before taking the plunge, consider these common mistakes made by rookies, and how to avoid them.

Trading without a stop-loss

Even with a 100% guarantee of your profit targets, you should better set a Stop Loss. Most traders tend to trade emotionally, and that is manifested in their refusal to accept losses as they come. The most crucial skill that one should have is the ability to accept they are on the wrong side of the market and accept the loss sooner. Failure to do that is the major reason many traders lose money. When trading with a stop loss, avoid moving it when the trade goes against you as that might blow up your account.

Risking more than they can afford to lose

Being drawn to the ideas of earning crypto life-changing money by simply being in the right place at the right time is a misplaced conception. If you risk more money than you can afford to lose, you will start trading with emotions. Trading with emotions makes you take bad trades that will eventually cost you money. To avoid this, always risk 1% of your trading capital, take a walk after each trade, and always trade during the least volatile hour.

Fail to plan and you plan to fail

Another common mistake novice make is to start out without a clear action plan. You should develop a precise plan, step by step and stick to it to have a good result. A good plan covers your personality, expectations, risk management rules and trading method(s). When followed, a trading plan will help cut trading errors and minimize your losses.

Trusting twitter calls, telegram signals, YouTube shills

Although social media can be a good source of information, it is crucial to remember that it is the same platform that people spread info related to their interests. Learn how to research reliable information and be aware of your targets and consider the timeframe you use for making your setup. Besides, do your own analysis and avoid copying other traders just because you see them making big profits.

Having Unrealistic Expectations

Let us be honest, trading crypto is not a get-rich-quick scheme. Success requires discipline and persistence to master the strategies. Most traders, especially after they incur a couple of loses, try to risk more than they had planned, anticipating the market will reward them. They end up losing even more. Well, the market doesn’t care about our individual desires, and thus it’s imperative to stop having unrealistic goals and stick to safe trading.

Frequently Asked Questions

1) How do I trade Ethereum?

To trade ether, you need the following:

- Choosing how you would like to trade ether

- Discover how Ethereum works; learn the difference between Ethereum and ether

- Look into factors that influence its price

- Place your first trade

2) Is day trading a good way to make money?

Just like any other trading strategy, day trading is risky, but at the same time potentially lucrative approach. With the right discipline and sticking to your strategy, you can profit from the short-term price fluctuations. All it takes is consistent and the will to put in the time and effort needed to learn how to be a better trader.

3) How to make money trading Ethereum?

There are a couple of ways you can earn money with Ethereum. You can invest in this cryptocurrency through Ethereum Investment Trusts or by banking on Ethereum. Alternatively, you can buy ether directly or simply trade Ethereum derivatives.

The Takeaway

The worldwide crypto market is quite attractive to many traders because of access to high amounts of leverage, 24-hours trading, and its low account requirements. When approached like any other business, crypto trading can prove quite profitable and rewarding. In short, crypto traders can evade losing money in the crypto world by:

- Having a well-thought trading plan

- Studying and researching hard

- Have a sound money management skill

- Approaching trading as a normal business and treating it with respect

By following these simple steps, your chances for consistent success in crypto trading will improve steadily!

.jpg)

.jpg)