Bitcoin / Shutterstock Bitcoin rallied more than $50,000, surpassing the critical psychological level as the bullish momentum resumed after ...

|

| Bitcoin / Shutterstock |

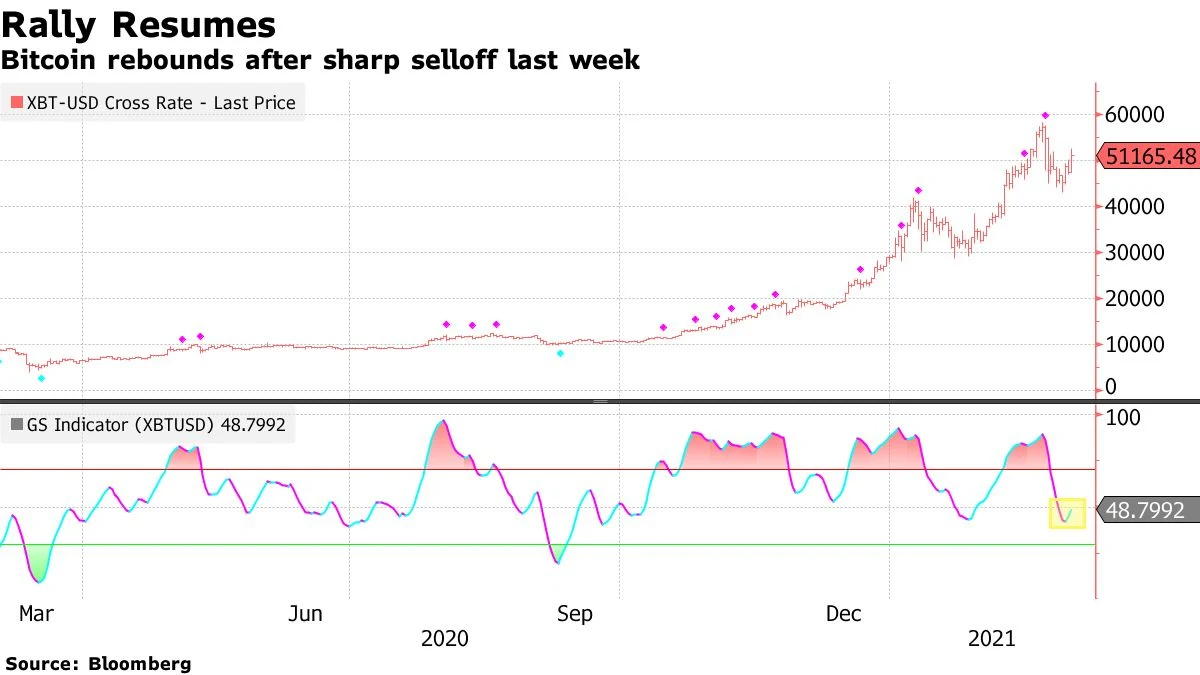

The world's cryptocurrency has been unstable, with prices plummeting 21% last week, followed by a sharp rebound in global stock markets earlier. Technically, the GTI global strength indicator, which detects trend fluctuations, has begun to curl up, which indicates the bullish trend of Bitcoin.

"With the return of stimulus activities in the United States and elsewhere-this is very beneficial for scarce assets such as Bitcoin," said Anthony Trenchev, managing partner and co-founder of Nixor Crypto Bank in London. At the same time, more and more well-known investors are also supporting crypto trading. Billionaire hedge fund manager, Bloomberg reported late Tuesday that Mark Lasley and Christopher Giancarlo invested in the digital Assets

Ed Moya, the senior market analyst at OANDA, said: “Bitcoin is now mostly recognized universally. “we are still in the early stages of this institutional interest, which is why I think you might make people more open to crypto. "The institutional investments underscore the growing trend of institutional funds flowing into the digital space. This trend has also attracted the attention of regulators as emerging industries are seeking a place in mainstream finance.

The prospects of the cryptocurrency industry are still being debated fiercely. Supporters point out that institutions are adopting more and more, while critics believe that Bitcoin is a huge bubble that is destined to burst like the boom and bust cycle of 2017.

Regulators

Tuesday, the US Securities and Exchange Commission (Securities and Exchange Commission) chairman candidate Gary Gensler said that ensuring that the crypto market is free from fraud and manipulation is a challenge for the agency. Gensler, who served as the chairman of the CFTC during the Obama administration, has always been considered a strong advocate of digital assets. He is a senior consultant for the Digital Currency Initiative of the MIT Media Lab, teaching blockchain technology and digital currency.

"Although the Bitcoin market responded quickly to his comments, Gensler is basically positive about Bitcoin and other cryptocurrencies," said John Wu, president of the blockchain technology company Ava Labs. "I hope the new government can help promote innovation in blockchain, cryptocurrency, and digital assets, rather than stifle it.