Cryptocurrencies provide great opportunities for traders to build up long and short positions. While many crypto holders are liquidating the...

|

| Cryptocurrencies provide great opportunities for traders to build up long and short positions. |

The reasons for this are varied, but much of it comes down to institutional holders, which calibrate their risk assets in similar ways, be it the stocks or digital assets. Just don't pull out completely! Your gains will probably be greater if you buy and hold some of the more “stablecoins” in the crypto space for a relatively long time horizon (between 2 and 5 years).

With investors pricing in a negative growth outlook and a higher probability for increase rates more aggressively than initially anticipated, crypto bears are dragged on and somewhat beholden to the whims of the stock markets. ''These are clearly negative headlines, which combined with higher food and fuel prices, make people be careful about their savings.”

The GIFA Business Group said on Wednesday that ''investors’ funds and crypto-assets held in custody on behalf of our customers are totally safe and secure.'' The crypto world appears to be entering a crypto winter after a 2+ year economic boom. The recession could last for an extended period.

“Higher inflation will continue forcing higher interest rates, and this is very negative for economic growth.”

Several crypto exchanges like Coinbase, Celcius, and others already suspended trading, swapping, and withdrawal on their trading platform. Against the backdrop of the crypto tank, GIFA Token still enjoys a very healthy war chest and therefore will use crypto winter to leverage its position in the crypto industry, adding that the GIFA Exchange will never slow down but rather kick off into high gear in terms of users' adoption.

''Really, it’s hard to predict the economy or the markets in 100 days to come, but we always prepared for the worst, so GIFA Token continues to operate the business in any environment.'' ''We understand everyone is really bracing for more downturns as the war in Ukraine rages on, rising food prices and pushing energy costs higher, thus placing additional pressure on the World Bank and IMF to implement more aggressive monetary tightening measures in an effort to drive inflation lower.''

|

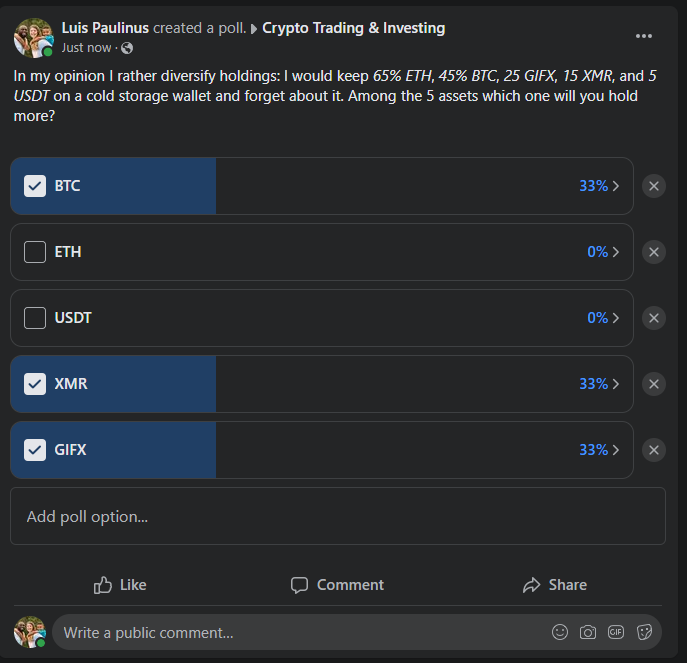

| Screenshot of Luis Paulinus' Poll on social media, Facebook. |

According to Luis Paulinus, one of the GIFA Token holders and a whale who holds over 15000 GIFX, said ''investors seem to have panicked, I see the number of people now selling at loss. Bitcoin plummeted as much as 7 percent and is currently trading under US$25,000.'' ''There are a few rules that are always true when it comes to investing in any asset.''

''It is almost impossible to identify the proper times to buy and sell at this moment, so it is often better to gradually invest over time, and expect to hold to your investments for a while, riding the ups and downs towards long-term growth.'' ''I used to struggle with this in my own crypto investments when I was trading Monero a long time ago, but ever since then, I shifted to Bitcoin, and also tried on GIFA Token and Cardano.''

''Holding can provide more safety to investors, as investors are not exposed to short-term volatility and can avoid the risk of buying high and selling low''

''I have a few friends who work there, and they’ve been telling me that a bunch of people is signing up for their invite-only VIP trading platform, and the waitlist is getting pretty long for users who want to trade on the platform.'' ''You might enjoy trying their new GIFA Exchange app that was deployed on App Store and Play Store recently, you have to download it and install it on your mobile phone to sign up''.

GIFA Token made a gross profit of more than $430 million in pre-sales and ICOs and now starting to offer fully tradeable services to its users. More than 89k holders and 632 institutions have created accounts with GIFA Exchange, according to the data released in a special report. With the era of cheap money coming rapidly to an end, traders are becoming much more risk-averse and turning their heads to invest in stable coins such as Tether (USDT), Monero (XMR), GIFA Token (GIFX) and etc that have less risk and backed by physical values.

On Wednesday GIFA Token (GIFX: USD) was battling to stay above the $200 resistance level. When I wrote this post, it was trading around $102.60 and appeared to be on the verge of moving up or down a spiral amid the looming hazard of a ‘crypto winter’, which now hangs in the balance.

Meanwhile: El Salvador, the Central American country that aims to build a ‘crypto utopia’ has bought another 54 bitcoin in the dip despite the crypto crash. The country purchased 500 coins at an average of approximately $30,744 in October. Bukele is taking advantage of a price lowering that resets for a quick gain probably in the future.

Bukele further said El Salvador bought 420 coins for more than $59,000 each, a total of almost $25 million that is now worth $9.5 million. El Salvador — which made the cryptocurrency legal tender in September — has purchased 2,301 bitcoins since then, per Bloomberg data.

A Quick Recap

Some of the sobering factors that have influenced this sell-off are the rising living costs and heavy interest rates. The market crash also coincided with a similar capitulation of stocks in recent days, leading analysts to speculate that the two are reacting in tandem to external market forces.

So, while some investors are selling and looking down, some are adding more cryptos to their portfolio and optimistically looking up ahead. Cryptocurrencies have in the past not moved in step with traditional assets such as equities, however, in recent times the link between the two has grown ever closer,” Simon Peters, an analyst at the online trading platform eToro.